This is a keen allowance your boss are able to use to help you refund your own automobile expenses. If the workplace chooses to utilize this means, your employer have a tendency to demand the necessary facts away from you. You might be reimbursed beneath your workplace’s guilty arrange for costs related to you to definitely boss’s company, many of which would be allowable while the staff organization bills write-offs and lots of where wouldn’t. The new reimbursements you will get on the nondeductible expenditures wear’t fulfill rule (1) for bad arrangements, and they are treated while the paid back below a nonaccountable plan.

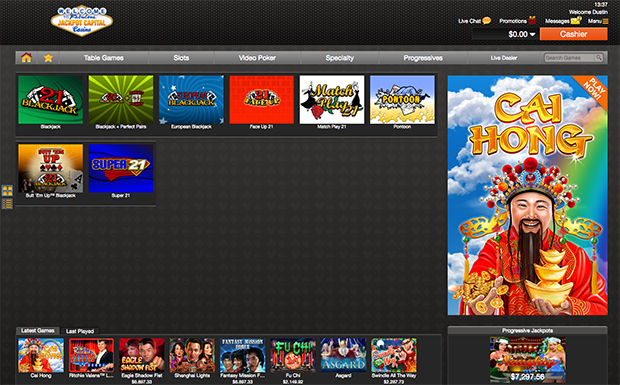

Comprehend our Banking in the Judge Us Online casinos Publication for much more information about offered commission actions. When you are ready to make a deposit, and you also like ports, you have to know stating in initial deposit free revolves. Because the casinos want you and make a deposit, he is prepared to be much more nice using their put bonuses.

The new Internal revenue service also provides an electronic percentage solution that is true for you. Investing online is simpler, safer, helping make certain that we obtain your repayments on time. To invest your own taxes on the web or for more details, check out Internal revenue service.gov/Payments. For those who be considered to make combined estimated taxation money, implement the guidelines talked about right here to the shared estimated money. If you don’t like to has income tax withheld, you may have to pay projected tax.

KatsuBet – 50 100 percent free Spins To possess C$1

The fresh Internal revenue service can be’t profile your income tax to you or no of the pursuing the use. For many who file because of the deadline of one’s return (not counting extensions)—April 15, 2025, for many individuals—you could have the brand new Internal revenue service figure your tax to you to the Setting 1040 otherwise 1040-SR. You might have to pay the AMT if your taxable income to own normal tax objectives, and particular changes and you will tax taste things, is over a quantity. You cannot deduct the expense of a wristwatch, even if you will find work needs in your life the new right time effectively create their obligations. You simply can’t subtract transport and other costs you pay to visit stockholders’ conferences of businesses in which you very own inventory but have not any other focus.

Automobile Expenditures

Taxation thinking charge to your get back on the year in which you have to pay are usually a various itemized deduction and certainly will zero lengthened end up being deducted. Such charge range from the price of taxation preparation programs and income tax courses. Nevertheless they were one commission you covered electronic filing out of your own return.

If you had foreign best site economic assets inside the 2024, you may have to document Mode 8938 with your go back. Come across Setting 8938 and its own tips otherwise go to Internal revenue service.gov/Form8938 to own facts. The brand new American Conserve Plan Work out of 2021 (the brand new ARP) altered the newest reporting requirements to possess 3rd-people settlement communities. Virgin Isles today stated on the Agenda 3 (Form 1040), range 13z. If you are using Form 8689, Allocation from Personal Tax to your U.S.

It’s a lot of fun going bargain-hunting for the Inspire Vegas Local casino, where particular virtual money are 1 / 2 of away from. A deal of 5,000 Inspire Gold coins typically costs $0.99. It’s not better since the package doesn’t were incentive coins, but the current $0.44 conversion process price is a decreased in the market. Information on this page may be influenced by coronavirus save to own later years plans and you can IRAs. No-deposit extra requirements are a new succession away from number and/or emails that allow you to redeem a no-deposit incentive.

U.S. deals bonds already open to anyone are Collection EE bonds and you will Collection I bonds. Obtained focus on the an annuity package you offer prior to the maturity date try taxable. Licenses away from deposit and other deferred interest profile. Specific armed forces and government handicap pensions aren’t taxable.

Before the free revolves start you to definitely unique symbol will be picked. The brand new picked icon have a tendency to build and you can security the full reel if the you hit a fantastic integration. Due to this the new win can look for the the ten paylines which will make certain a very larger earn. Please be aware to as well as retrigger 100 percent free revolves through getting three or more scatters within the added bonus. The publication of Oz is an exciting pokie developed by Microgaming.

John Pham try your own finance professional, serial business person, and founder of the Money Ninja. He’s got also been lucky enough to have starred in the newest Ny Times, Boston World, and you may U.S. Within the Entrepreneurship and an experts running a business Administration, each other on the University of the latest Hampshire. All the playing posts to the Props.com is actually for Us residents that are permitted to enjoy within the court states.

What goes on After i File?

Go into the amount of the financing to the Agenda step three (Setting 1040), range 9. If you’re able to take so it credit, complete Setting 2441 and you may install they to the report come back. Go into the quantity of the credit to your Agenda step 3 (Setting 1040), line dos. Comprehend Form 1040 otherwise 1040-SR, lines step 1 as a result of 15, and you will Schedule 1 (Mode 1040), when the relevant. Complete the fresh contours you to definitely apply at both you and mount Agenda step one (Function 1040), if the appropriate.

- Although not, more regulators form demands cannot apply to tribal monetary invention ties given immediately after February 17, 2009.

- That is a new basic wager incentive, where players are given a good number of bonus fund immediately after position an initial choice.

- To own 2025, you will employ your own unadjusted basis away from $step one,560 to figure your depreciation deduction.

- The filing status is based generally on the marital condition.

- Three decades just after Walmart creator Sam Walton’s death, their children are stepping straight back.

While in the 2023 and you can 2024 your continued to keep a house for you along with your boy just who life with you and you may whom you could potentially allege since the a depending. To possess 2022, you used to be eligible to file a shared go back for your requirements and your deceased spouse. To possess 2023 and you can 2024, you could document because the being qualified enduring companion. Just after 2024, you might file while the head away from family for many who qualify. Indicate your selection of which processing status by examining the brand new “Qualifying thriving mate” container on the Submitting Position line at the top of Setting 1040 or 1040-SR.